The historic advancements within the offshore wind sector is owed to the effort of both public and private research, forming of partnerships to address specific challenges, and to governments working with academia and industry to enhance/accelerate the technological development. This has led to both the technology of a modern offshore wind power plant and shared industry norms and standards, enabling economies of scale.

From its outset, offshore wind technology relied heavily on advances made in the much larger onshore market, which had emerged in north-western Europe following governments’ effort to diversify energy production after the two major oil crises of the 1970’s.

When market volume grew, so did offshore wind energy as a specialised research area. Initially, the focus was to develop technical norms and standards for offshore wind turbines and to ready the turbine models for harsh offshore conditions.

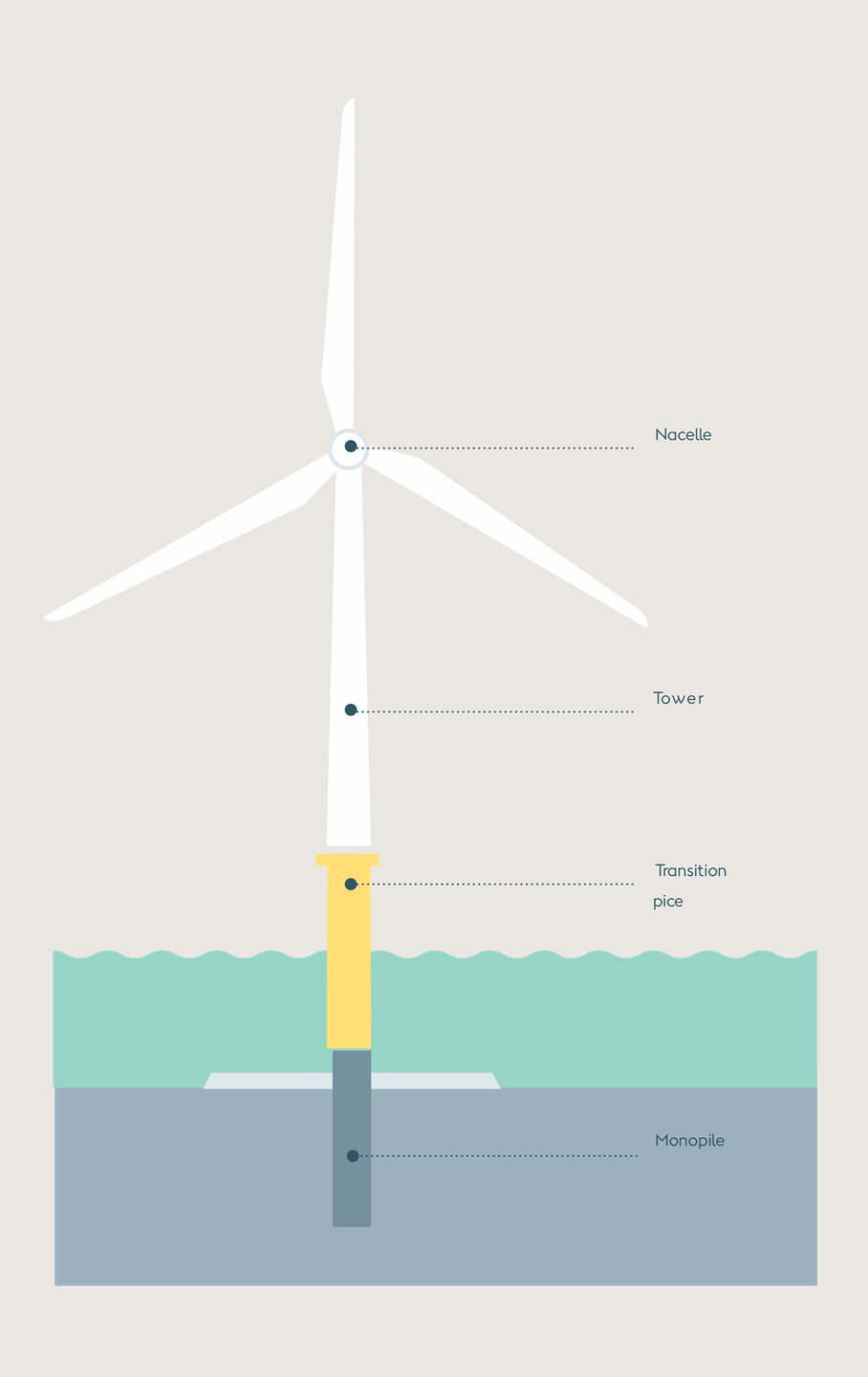

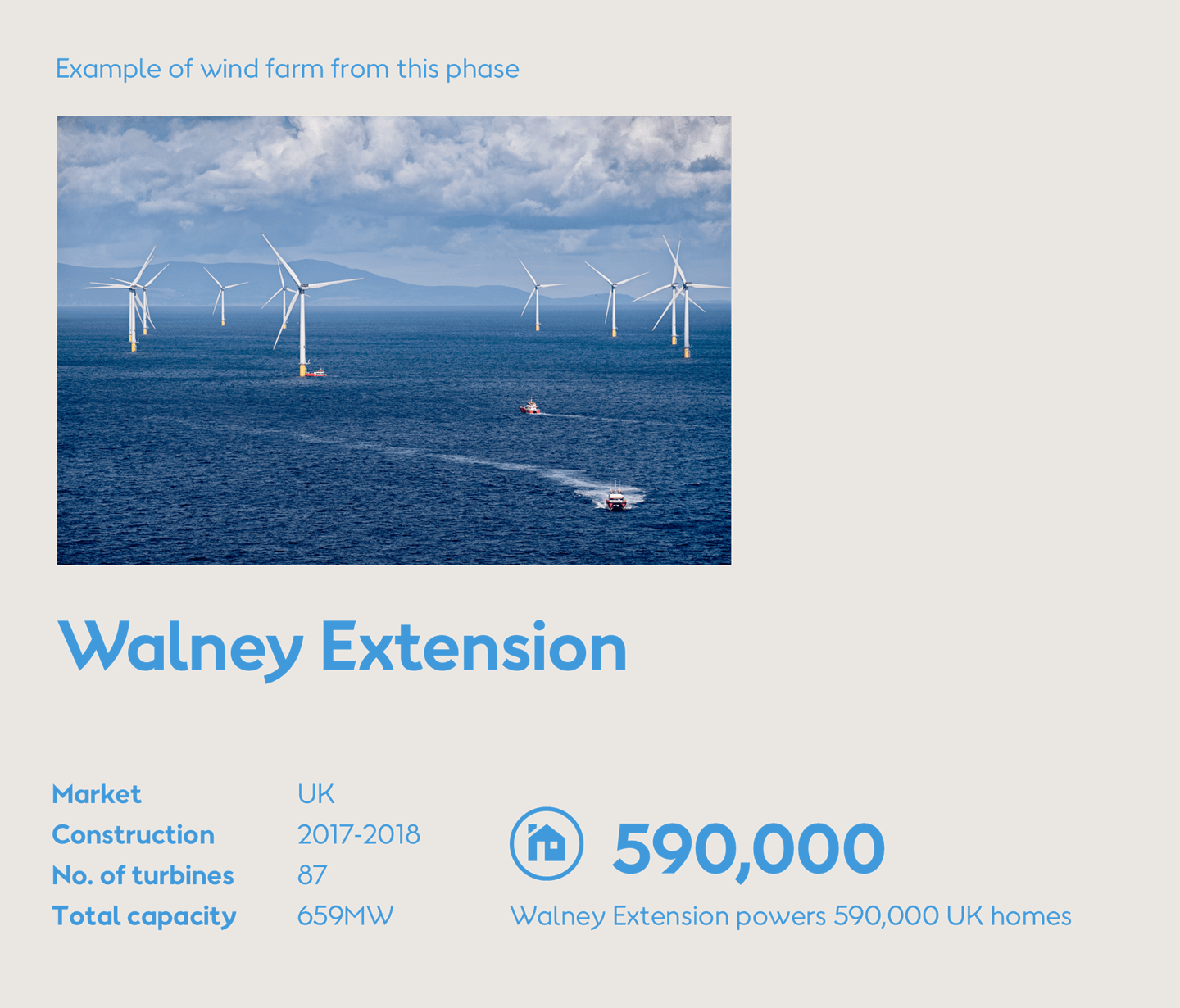

As offshore wind projects reached utility scale in the early 2000’s, the research scope expanded to the entire offshore wind power plant. Norms and standards were now developed at farm level. Research in seabed, waves and wind conditions enabled improved foundations and farm layout to increase yield. And by 2014, the first projects using dedicated offshore wind turbine platforms were commissioned, following years of research and development.

Today, research and development projects on grid integration and sector coupling have emerged, as energy markets are increasingly dominated by renewable generation.

Development through pragmatic collaboration

Industrial players have generally been pragmatic in partnering together and with research institutions on a project-by-project basis. And to optimise resource allocation, industry associations and governments established fora to identify strategic challenges in order to target public and private research spending towards overcoming these challenges. This coordination helped creating a pull demand for innovation and facilitating technologies as they moved towards commercialisation.

Long-term commitments by governments to underpin the research in offshore wind also allowed for common large-scale test facilities, where components and even entire turbines could be tested in full scale