Why are we focusing on supply chain decarbonisation?

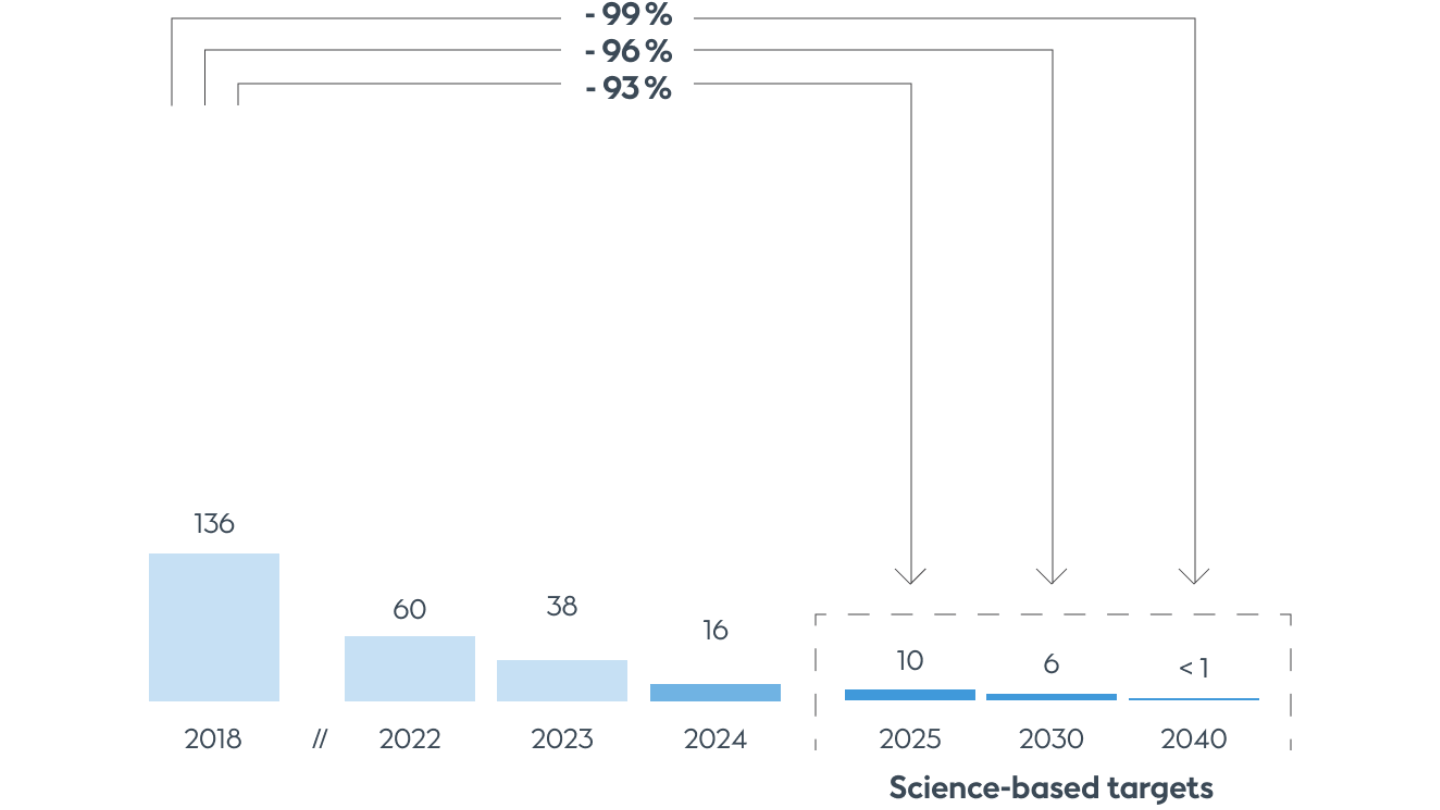

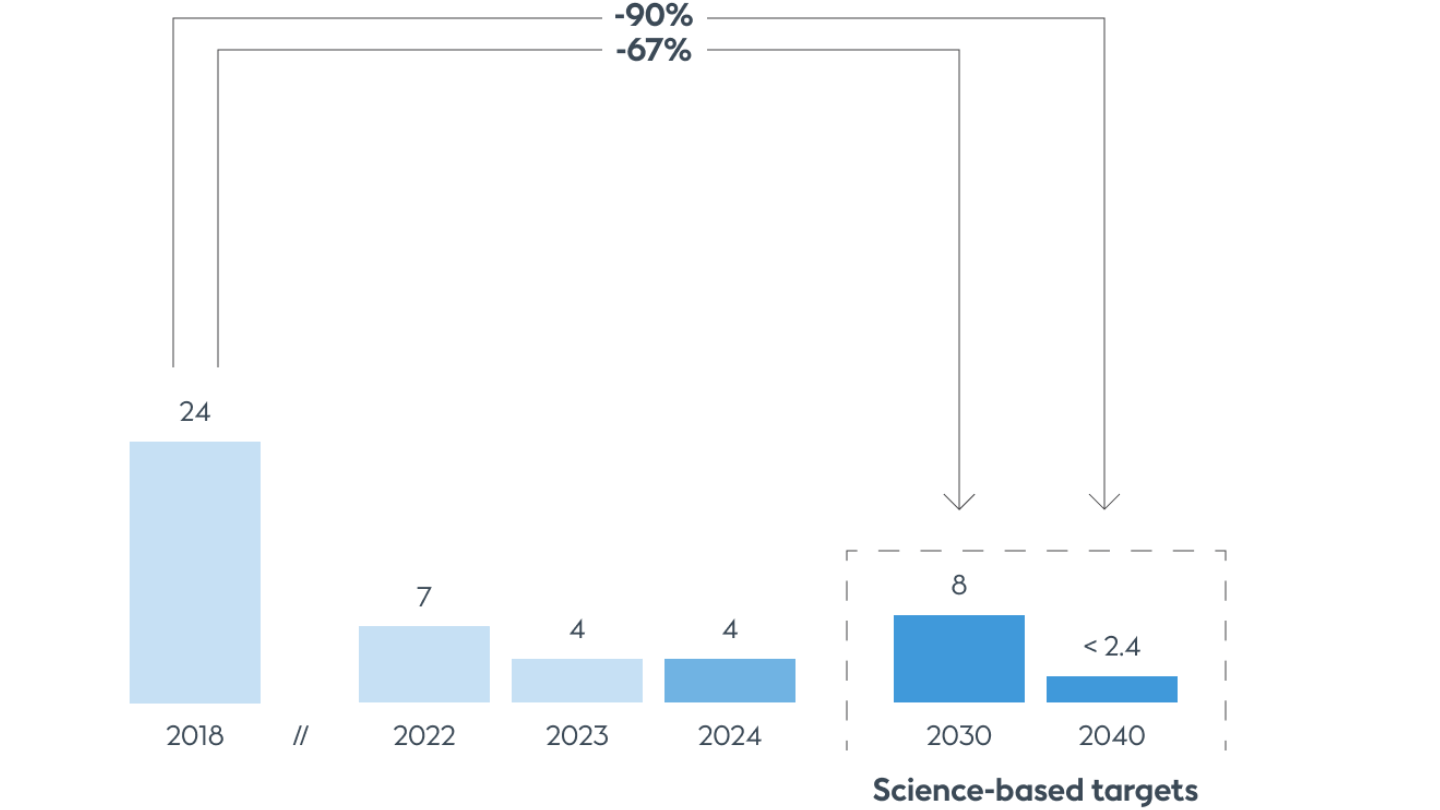

At Ørsted, we have the most progressive decarbonisation targets in the energy sector, and we aim to reach net-zero greenhouse gas emissions across our whole value chain (scope 1-3) by 2040. Find out how we're reducing our scope 3 emissions – those that come from our supply chain and the use of the natural gas we sell.

“

We need to find ways to decouple the growth of our build-out from the growth of emissions in our supply chains.

We’re gradually phasing out natural gas sales from our business portfolio. This will eliminate the vast majority of our scope 3 emissions. But it still leaves emissions linked to our supply chain, including those from the manufacture, installation, and transportation of our renewable energy assets – activities that all need to grow as we accelerate the build-out of green energy.

This makes supply chain decarbonisation one of the most important and complex parts of our work to reach net-zero.